Understand your Options for Franchise Business Funding

Small Business Administration Loans

If you are considering investing in a franchise, they should be registered with the SBA Franchise Directory which will make your funding process more streamlined.

Click here to view the SBA Franchise Directory

Traditional Business Term Loan

Secured vs Unsecured Lines of Credit Definitions

A business line of credit is a loan that operates like a credit card, you are offered a certain amount of capital to draw from and are required to pay back based on what amounts you borrow from the line of credit. This can be used for starting a new franchise or business in many cases. The borrower can use the line of credit at any time, pay it back, and borrow again, up to a maximum limit set by the lender.

Lines of credit can be secured or unsecured and there are significant differences between the two, primarily the interest rate, when you secure a line of credit you are essentially giving the lender security if you default on the loan and therefore, it is offered at a lower rate of interest.

SIGNIFICANT ITEMS RELATED TO LINES OF CREDIT

- A secured line of credit is guaranteed by collateral, such as a home, vehicles, assets or something that the lender could take if you default on your loan.

- An unsecured line of credit is not guaranteed by any asset; one example is a credit card. This is generally the highest risk version of lending for the lender and like most credit cards, is the highest interest rate.

- Unsecured credit always comes with higher interest rates because it is riskier for lenders.

When any loan is secured, the lender has established a right to take an asset that belongs to the borrower if the borrower does not pay the amounts borrowed back to the lender. This asset becomes collateral, and it can be seized or liquidated by the lender. A typical example is a home mortgage or a car loan. The bank agrees to lend the money while obtaining collateral in the form of the home or the car.

Similarly, a business or individual can obtain a secured line of credit using assets as collateral. If the borrower defaults on the loan, the bank can seize and sell the collateral to recoup the loss. Because the bank is certain of getting its money back, a secured line of credit typically comes with a higher credit limit and a significantly lower interest rate than an unsecured line of credit does.

Both unsecured and secured lines of credit are generally strong options for new franchise and business owners in that the process to obtain the loan is generally fast and efficient. For a new franchise owner, you should typically have a 650 credit score an no bankruptcies in the last ten years.

Franchise Funding Options

Are you considering buying a franchise or starting a new business? There are a wide range of franchise funding options for new business owners and franchise investors. Typically, Franchising offers new business owners a higher rate of success and less risk starting a new business.

Before you’ve made your decision, contact us for information on your funding options and how much capital is available for you and your new franchise business.

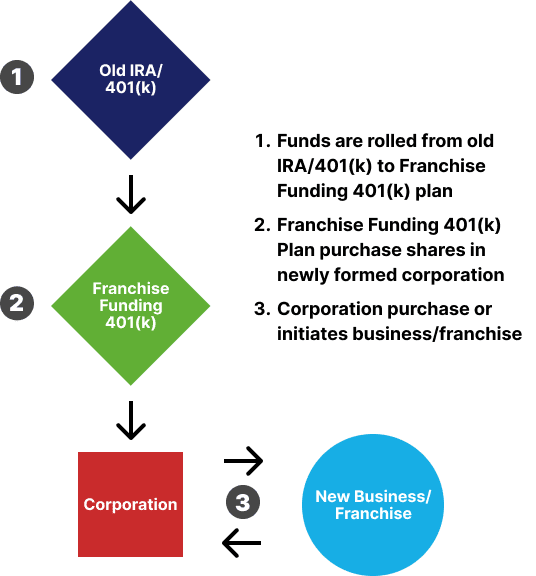

How Does This Work?